Enhancing Security Standards: Adjusting Methodology and Introducing CCSS to CER.live Rating

At CER.live, our mission is to provide accurate and comprehensive security ratings for cryptocurrency exchanges. As the digital asset ecosystem evolves, so must our evaluation methodologies. We are excited to announce significant updates to our Security Rating System to enhance transparency and align with the latest industry practices.

Why Update Our Security Rating System?

Cryptocurrency exchanges are vital to the digital asset economy, serving as primary gateways for trading and investment. Ensuring their security is crucial for user protection and market trust. Our rating system must reflect the latest security advancements to provide up-to-date assessments. Also regulatory bodies such as ADGM, VARA, and others place special emphasis on the transparency, certification, and security of cryptocurrency companies that inspire us to raise standards to new levels.

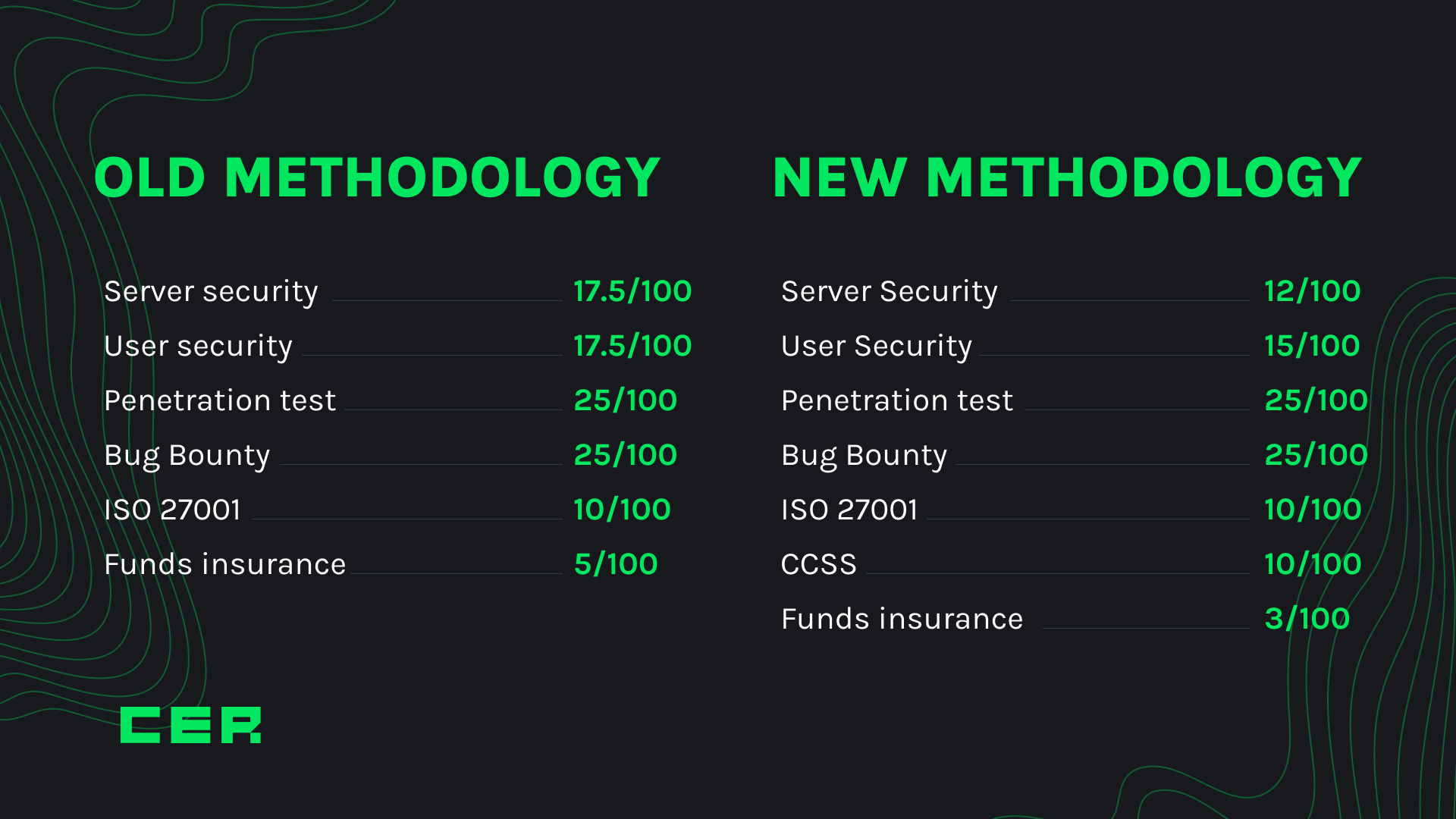

Key Changes to Our Evaluation Criteria

1. Incorporation of Latest Security Practices

Our updated rating system will now include the latest security practices, ensuring that our evaluations are comprehensive and reflective of current industry standards. This includes enhanced protocols for data protection, transaction security, and user authentication.

2. Introduction of CCSS certificate

Due to the fact that access control is one of the biggest threats to cryptocurrency projects—and the primary cause of most fund thefts last year—we have decided to introduce a CCSS (Cryptocurrency Security Standard) certificate. This should help prevent similar incidents in the future.

3. Introduction of Proof of Reserves (PoR)

One significant addition to our criteria is the Proof of Reserves (PoR) metric. This metric enhances transparency regarding an exchange’s solvency, assuring users that their assets are fully backed by corresponding reserves. By incorporating PoR, we aim to foster a more trustworthy cryptocurrency ecosystem.

The 3rd-party Proof of Reserves Audit will be part of the certification on CER.live, despite currently not being part of the Total Score. We have implemented the 3rd-party PoR Audit instead of the outdated Proof of Funds certificate.

We would like to emphasize that the third-party Proof of Reserves Audit is very important from a user perspective. It demonstrates the exchange’s openness and transparency and confirms that all exchange obligations are backed by reserves. This contributes to the development of the cryptocurrency ecosystem and strengthens users’ trust.

What Is Proof of Reserves?

Proof of Reserves is a method by which exchanges demonstrate solvency by providing evidence that they hold enough assets to cover all customer balances. This typically involves third-party audits that verify the exchange’s holdings and ensure all liabilities are adequately backed. The most important factor is:

- Submission of Proof of Reserves audit with Proof of Liabilities at least once a year.

Impact on Existing Security Ratings

Listed exchanges must submit their latest CCSS certificate and Proof of Reserves reports to maintain or improve their security ratings and certifications on CER.live. Exchanges that do not provide these reports may see a decrease in their ratings or lose certification, as transparency and solvency are now crucial components of our criteria.

How Exchanges Can Comply

To ensure a smooth transition and help exchanges comply with the new requirements, we are offering our auditing services to assist in conducting Proof of Reserves audits and CCSS certificates. Exchanges can submit their existing PoR reports or request our services to obtain a comprehensive audit.

Benefits of the Updated Rating System

- Enhanced Transparency: Users will have greater confidence in the solvency of exchanges.

- Improved Security Standards: Imposing the latest security practices helps exchanges protect their platforms and users more effectively.

- Increased Trust: A higher security rating, backed by rigorous audits, boosts user trust and potentially attracts more customers.

At CER.live, we are committed to fostering a secure and transparent cryptocurrency ecosystem. By updating our Security Rating System and introducing the Proof of Reserves certification, we aim to enhance the reliability of our evaluations and support exchanges in adopting best-in-class security practices. These changes will benefit the entire digital asset community, promoting greater trust and stability in the market.

Stay tuned for more updates. Feel free to reach out with any questions or for further assistance.

Updated July 2, 2024